Do you have to pay taxes on an inheritance?

As of 2016, only eight states still levy an inheritance tax. Even if you live in one of those states, many beneficiaries to an inheritance in the form of cash income or property are exempt from paying it. Do you have to pay tax on an inherited property? This guide clarifies whether you do or don’t.

Inheritance Tax & Estate Tax

The crucial difference between estate taxes and paying tax on an inheritance lies in who’s in charge of paying it. An estate tax is imposed on the overall value of the property and a deceased person’s money and is paid out of the decedent’s assets before any distribution to beneficiaries.

Nevertheless, before an estate tax is due, the value of the assets must exceed certain thresholds that change each year, but usually, it’s at least $1 million. Because of this threshold, only about 2 percent of citizens will ever fall upon this tax.

How inheritance tax works

Once the executor of the estate has divided the assets up and distributed them to the beneficiaries, the inheritance tax comes into play. The tax amount is calculated individually for each individual beneficiary, and the tax must be paid by the beneficiary. For example, a state may charge a 5 percent tax on all bequests larger than $2 million. Consequently, if your friend leaves you $5 million in his will, you just pay tax on $3 million, which is $150,000. The state would require you to report this information on an inheritance tax form.

States with an inheritance tax

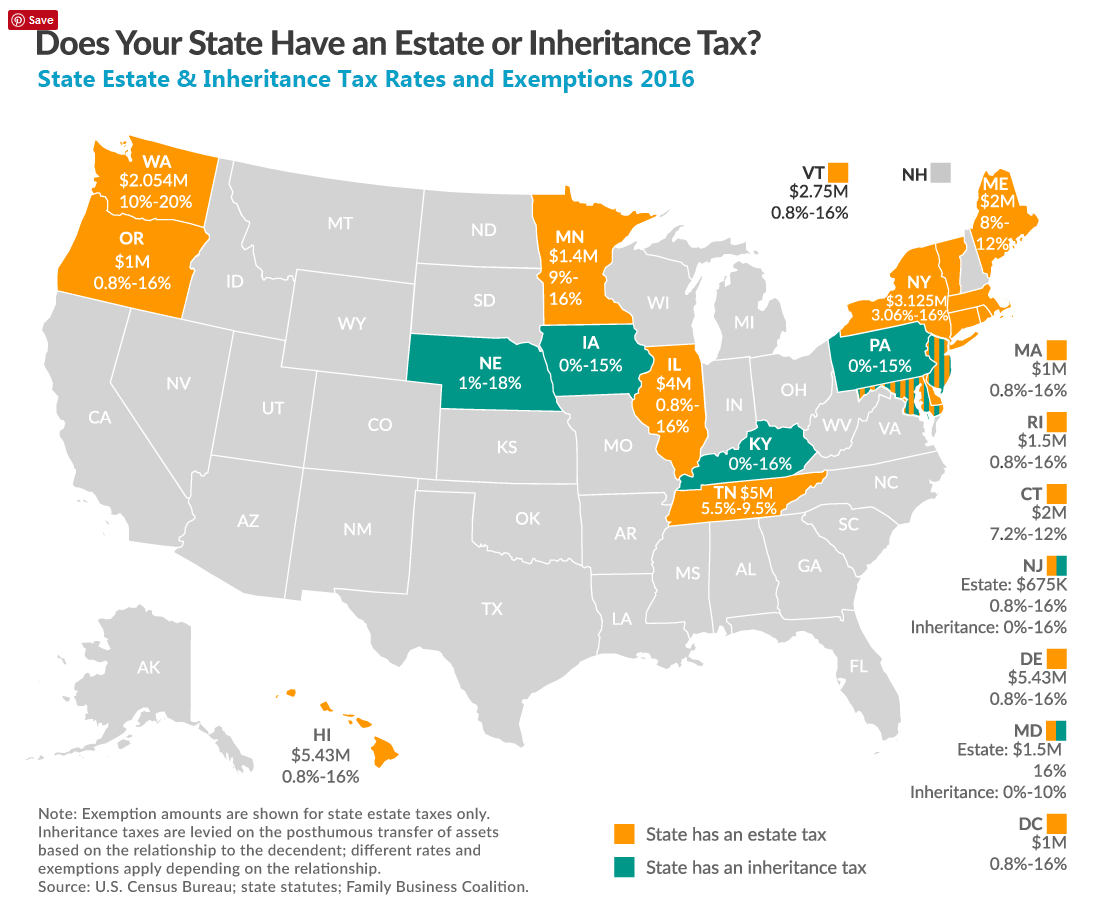

The federal government does not have an inheritance tax. The eight states that levy an inheritance tax comprise Indiana, Iowa, Kentucky, Maryland, Nebraska, New Jersey, Pennsylvania, and Tennessee. Of course, state laws are subject to change, so if you are receiving an inheritance, check with your state’s tax bureau. The tax rates on bequests can be as low as 1 percent or as high as 20 percent of the value of property and cash you inherit.

Hawaii and Delaware have the maximum exemption threshold at $5,430,000 (matching the national exemption). New Jersey has the lowest, just exempting estates up to $675,000.

New Jersey and Kentucky are behind with top speeds of 16 percent.

Repeal and reform of inheritance and estate taxes have been quite regular in states you mightn’t anticipate, occasionally in the last few years. In 2013, Indiana sped up the repeal of its inheritance tax to January 1, 2013. The estate tax of Tennessee will phase out completely in 2016. Maryland and New York are in the procedure for phasing in new, higher estate tax exemptions, finally matching the national exemption amount ($5.9 million) by 2019. Minnesota is in the procedure for doubling its exemption from $1 million to $2 million over five years.

Inheritance and estate taxes are one of the most dangerous taxes to economic growth, have been shown to suppress entrepreneurship, and have substantial compliance costs.

The Stepped-Up Basis Rules Change Those Who Inherit Property

Step up in basis is the readjustment upon the inheritance of the worth of an appreciated asset for tax purposes, discovered to be the higher market value of the asset at the time of inheritance. When a house is passed on to a beneficiary, its worth is usually more than when the previous owner bought it. “Basis” means the asset’s price used for tax purposes. To ascertain whether you have a gain or less when you sell an advantage, its basis is subtracted by you from the sale cost. You’ve got a gain if you’ve got a positive number. You’ve got a loss if you’ve got a negative number.

The basis of a dwelling you construct or purchase is its price, plus any improvements you make while you possess it.

Nevertheless, the tax basis of a home’s is established after the owner dies otherwise when someone inherits a house. This implies that the price for tax purposes of the home’s isn’t what the -deceased earlier owner paid for it. This will typically be more than the earlier owner’s basis.

The bottom line is that if you after sell it and inherit property, you pay capital gains tax based just on the worth of the property as of the date of death.

Example: Jean inherits a house from her dad John. He paid $100,000 for it over 20 years past. John made $20,000 in progress over the years, so his ‘s tax basis in his house just before died was $120,000. However, when the house is inherited by Jean its basis is stepped-up to its fair market value on the date of the departure of John. Jean has the house appraised and this value is set at $300,000. The house is sold by jeans for $310,000 a few months after she inherits is inherited by her. $300,000 is her tax-basis on the house. She subtracts this amount from the sales price to establish her gain that is taxable: the Sold price of 310,000 – $300,000 = $10,000 gain.

If you sell an inherited dwelling for less than its stepped-up basis, you’ve got a capital loss that can be deducted (assuming you do not use the dwelling as your private residence).

However, there is a max of $3,000 of total losses can be deducted against your income every year. Any excess must be spread out and deducted on future tax years until the total amount is deducted.

Check out the IRS publication http://www.irs.gov/publications/p544/ch04.html#en_US_2013_publink100072633

Inheritance tax exemptions

Depending on your own relationship to the decedent, you may receive an exemption or decrease in the amount of inheritance tax you must pay. For example, most states exempt a partner from the tax when the property is inherited by them from another partner.

Children and other dependents may qualify for the exemption that is same, though, in some scenarios, just a portion of the inherited property may qualify. Normally, the higher rates of tax will be paid by those who inherit property from a decedent with whom they don’t have any genetic relationship.

- Created On: October 4, 2016

- Last Updated On: October 12th, 2017 at 2:15 am

- Selling Your Home

- One Comment